BitMine Ethereum Holdings Reach 2.1 Million Following a New 46,255 ETH Purchase

Earlier today, Ethereum (ETH) treasury firm BitMine Immersion Technologies (BMNR) added to its ETH holdings, as on-chain data reveals that the firm purchased another 46,225 tokens, increasing its total ETH holdings to over 2.1 million ETH.

BitMine’s Total Ethereum Holdings Surge Past 2.1 Million ETH

BitMine appears to have significantly expanded its overall Ethereum holdings, per an X post by the on-chain analytics account Lookonchain. Notably, the company’s wallet increased its overall holdings by 46,225 ETH, bringing its total value to little over $200 million.

Recall that BitMine purchased 202,500 ETH on September 8th, enabling it to increase its total ETH holdings to over two million for the first time. The company’s ultimate goal is to own 5% of the entire Ethereum supply.

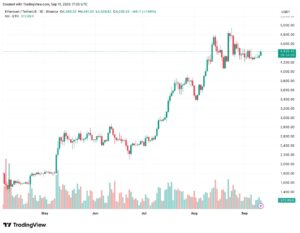

The company, which is listed on the New York Stock Exchange (NYSE), has spent the whole summer buying Ethereum. Since today’s acquisition, its total Ethereum holdings have risen above 2.1 million, and as of this writing, they are valued at about $9.27 billion.

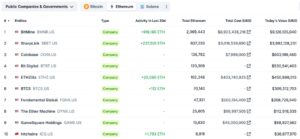

It is important to note that, out of all publicly traded firms, BitMine now owns the most Ethereum. With 837,230 ETH on its balance sheet, SharpLink is far below the top of the list, according to Coingecko data.

The top five ETH holders are completed by other companies such as Coinbase (136,782 ETH), Bit Digital (120,306 ETH), and ETHZilla (102,246 ETH). Interestingly, nine of the ten companies with the largest ETH holdings are situated in the United States.

ETH Giving Bitcoin A Run For Its Money

Attention has been gradually shifting away from Bitcoin (BTC), the largest cryptocurrency by market capitalization, as more businesses adopt Ethereum (ETH) as their preferred digital asset. This does not imply that ETH has entirely replaced Bitcoin, though.

Nevertheless, in 2025, businesses’ decision to include ETH on their financial sheets became much more popular. Robin Energy, a Cyprus-based company, revealed yesterday that it has purchased $5 million worth of Ethereum.

Likewise, SharpLink increased its total ETH reserves in August by purchasing an additional 56,533 ETH. Similarly, earlier this week, Yunfeng Financial, which is associated with Jack Ma, invested over $44 million in Ethereum.

As staking activity on the network keeps increasing at an exponential rate, ETH’s price may rise even more.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.