Paul Atkins Approaches the Role of SEC Chair: Will the Price of XRP Finally Reach a New High?

The Senate committee has concluded following months of Donald Trump’s nomination of Paul Atkins to be the SEC Chair. He has been nominated by the banking committee, but full Senate voting has not yet taken place. Nevertheless, the SEC’s update regarding the chair post generated a lot of favorable enthusiasm, which fueled the price increase for XRP.

Paul Atkins is nominated by the US Senate Banking Committee. For the Chair of the SEC

By a vote of 13–11, the US Senate Banking Committee has formally approved Paul Atkins for the position of SEC Chair. Both are scheduled for a full Senate vote in the coming weeks, while Jonathan Gould has also been nominated to head the Office of the Comptroller of the Currency (OCC).

Because of their pro-crypto stance, they will have a big influence on how crypto regulation is shaped if their role is confirmed. The price of XRP has been greatly impacted by the SEC’s decision regarding these regulatory responsibilities.

Senator Elizabeth Warren led the Democrats’ adamant resistance to the appointment, nevertheless. The SEC head who was chosen for deregulation prior to the 2008 financial crisis was assailed by critics, who also expressed concern about his prior affiliation with the defunct FTX exchange.

She had previously challenged the appointment of David Sacks as the czar for AI and cryptocurrency, which led to Sacks selling his $200 million cryptocurrency investment before taking the position.

Today’s Nearly 3% Increase in XRP Price: What Comes Next?

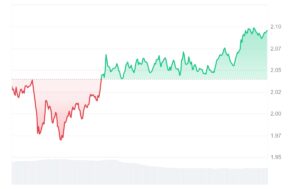

Today, amid the general market recovery, Paul Atkins’ nomination as SEC Chair, and much more, represents a significant trend shift following the price of XRP plummeting below the $2 mark. The Ripple coin has risen by almost 3% in the past day and is now trading at $2.08 with a market valuation of $123.36 billion.

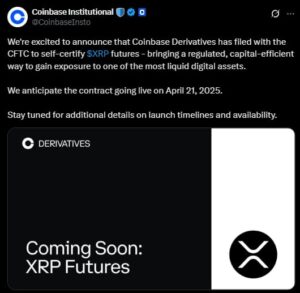

The XRP futures filing is driving the increase, but the trade volume is down 29%, suggesting that investors are feeling pessimistic. An important optimistic element for the altcoin is the fact that the well-known cryptocurrency exchange Coinbase filed for XRP futures, XRPL, on April 3 and is scheduled to go operational on April 21, 2025.

According to earlier CoinGape stories, the XRPL seeks to increase institutional engagement and liquidity. The price of Ripple may rise as a result of these and future cryptocurrency events in the US. In addition, investors expect the SEC to approve the XRP ETF this year, thus the chances of it being approved are strong.

These elements suggest a possible upward trend in the price of ripples with buyer dominance. However, the SEC’s secret meeting on April 3 coincides with the latest Justin W. Keener filing in the XRP litigation, which elicits conflicting opinions. Investors are waiting for updates from the SEC meeting to assess XRP’s trajectory while the uncertainty persists.

Will Paul Atkin as SEC Chair Cause the Price of XRP to Reach a New High?

Before the price of the Ripple cryptocurrency recovered after Gary Gensler resigned as SEC Chairperson, it had been in a total downward trend for a number of years. This is because XRP was continuously impacted by Gansler’s crypto regulatory position.

A stronger strategy and a chair who is crypto-friendly, like Paul Atkins, might have a big impact on the price, according to experts. Furthermore, the XRP price forecasts raise the prospect of an additional upward trend from this point on.

More green candles from this point might move the Ripple token back to a symmetric triangle, eventually driving its price to $2.80 before breaking out to $3.65, according to the crypto analyst CRYPTOWZRD X article.

Although this depends on various parameters, the XRP’s performance can rally with bullish stimulus like Atkins becoming the SEC Chair.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.