The price of Ethereum drops 20% overnight, and Peter Schiff warns that it could drop below $1,000.

Renowned economist Peter Schiff, a longtime opponent of cryptocurrencies, has warned Ethereum owners to be extremely cautious. According to his prediction, this digital currency might fall below $1,000. He blames recent market volatility and ETH’s persistent underperformance in comparison to Bitcoin and gold for his gloomy prediction. Schiff maintains that the present price trajectory reflects past downturn patterns, particularly the mid-2022 Ethereum price crash, citing the 20% loss Ethereum saw in a single day.

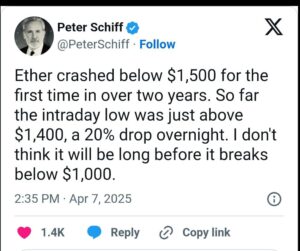

In a recent post on X, Schiff stressed that the fact that ETH fell below $1,500 earlier signifies a significant turning point. He pointed out that this cryptocurrency, which is currently around $1,400, finds it difficult to stay stable. The economist contends that deteriorating fundamentals and growing technical flaws point to an impending decline below the psychological $1,000 mark. His concerning forecast is still based on past patterns and observable market habits.

Mounting Losses Shake Ethereum’s Stability

Ethereum was especially heavily struck by the weekend market selloff, which caused a 20% price collapse. As a result, its worth dropped to almost $1,400. Even if ETH saw a minor recovery, analysts and investors are uneasy about its inability to decisively regain the $1,500 threshold. According to Peter Schiff, this breakdown is not merely a passing trend but rather a sign of more serious instability. He blames the lack of bullish momentum and waning market confidence for this volatility.

Schiff identifies ETH as particularly vulnerable, even though the price crash happened amid wider instability in the cryptocurrency market. He contends that because of inherent flaws in its ecosystem, ETH has long been unable to overcome the $2,000 resistance level. These include poor institutional uptake, unclear regulatory prospects, and growing competition from new smart contract platforms.

Comparative Performance Paints a Bleak Picture

Beyond Ethereum’s dollar-denominated losses, Peter Schiff Ethereum price prediction raises worries about the cryptocurrency’s notable underperformance in comparison to Bitcoin and gold. On ETH/BTC trading pairs, this digital currency keeps declining, indicating a rise in capital flight from altcoins to supposedly safer havens like Bitcoin. Schiff contends that this pattern reflects ingrained mistrust of ETH’s potential long-term benefits and value.

Furthermore, when Ethereum is valued in gold, its chart looks even more alarming. According to Schiff, ETH hasn’t been able to hold its own against the precious gold. This stands in sharp contrast to narratives that portray Bitcoin and Ethereum as digital substitutes for conventional value repositories. The chart is awful, and the price in Bitcoin is even worse than in US dollars. The critic cautioned, “Of course, its worst-looking chart is priced in gold,” implying that this cryptocurrency is failing on several valuation fronts.

Echoes of 2022 Heighten Fears of Another Ethereum Price Crash

Schiff thinks that the state of the market today is similar to that of Ethereum in June 2022, when the price of ETH dropped below $1,000 amid a larger crypto market meltdown. He contends that investor panic, risk-off sentiment, and liquidity constraints are all at work once more. Schiff is certain that this digital currency may soon return to those lows because there aren’t any clear reversal indicators.

In positive situations, some investors continue to hold out hope for a rebound, pointing to possible rallies toward $4,000. Schiff isn’t convinced by these ideas, though. He points to a persistent lack of institutional demand and the lack of positive on-chain data as indicators that any recovery in the near future would probably be brief. The economist contends that in the current climate, the risks greatly exceed the rewards.

Will Ethereum Prove the Critics Wrong?

The cryptocurrency market has frequently demonstrated its ability to undergo rapid reversals, notwithstanding Schiff’s gloomy view. Supporters of Ethereum assert that network improvements, growing developer participation, and technology breakthroughs may eventually rekindle positive sentiment. Future developments in decentralized finance and the deployment of scaling solutions could provide price catalysts.

However, Peter Schiff Ethereum warning underscores the fragility of the current market sentiment. Whether ETH price defies the odds or undergoes another significant downturn remains uncertain. For now, traders and investors brace for heightened volatility. Schiff’s $1,000 prediction casts a long shadow over this cryptocurrency’s immediate future.

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.