Binance CEO CZ Draws Attention to the Risks of Cryptocurrency Investing

The founder of Binance, Zhao Changpeng (CZ), has stated that risks are associated with investing in and staying away from cryptocurrencies. This message, which is disseminated throughout the cryptocurrency business network, complicates the current risk discussion.

While the short-term market swings are still minor, his cautions raise significant issues for interested parties. CZ’s advice is consistent with the larger theme of responsible investing.

The bitcoin community is examining Binance CEO CZ’s risk assessments.

A well-known personality in the cryptocurrency space, Zhao Changpeng, has reaffirmed his position regarding the risks associated with investing in digital assets. “Investing in cryptocurrency carries risks, and not investing in cryptocurrency also carries risks,” he said. Interestingly, his warning about the dual risks of investing in or not investing in cryptocurrencies had no immediate effect on the financial markets. According to prominent executives, this illustrates the ongoing ambiguity that permeates the current market atmosphere.

His remarks have not resulted in any notable financial changes as the industry takes his opinions into consideration. Among cryptocurrency aficionados, the balance between possible gains and hazards continues to be the main topic of discussion. Because of this position, exchanges such as Binance are still in operation with no discernible changes in the dynamics of trading.

Discussions on a variety of forums have been heightened by the wider community’s recognition of CZ’s recurrent themes around market risks. His comments frequently supplement previous lectures by individuals such as Vitalik Buterin, ensuring ongoing monitoring of cryptocurrency investment tactics. These discussions highlight a steady yet circumspect approach to the market.

Trends in the Bitcoin market while cryptocurrency leaders exercise prudence

Were you aware? Leaders in the cryptocurrency space have previously discussed the hazards, sparking intense market discussions that are mainly unregulated and instead promote the sharing of knowledge about digital asset strategies.

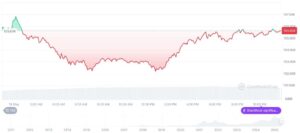

The most popular cryptocurrency, Bitcoin (BTC), is worth $106,481.72 at the moment and has a $2.12 trillion market valuation. With a commanding market share of 63.08%, Bitcoin’s trading volume is $60.71 billion, representing an 18.26% change. Notably, according to CoinMarketCap, the price of Bitcoin has risen by 25.01% in the last 30 days.

The team’s observations demonstrate how investing in cryptocurrencies has the potential to revolutionize the financial industry. However, for wider acceptance, considerable technological and regulatory reforms are still required. The future market environment may be determined by the creation of compliance frameworks in conjunction with innovations, guaranteeing both protection and long-term growth. Stellar’s official website offers information about decentralized networks and their effects on financial transactions for individuals who would like further background on this continuing discussion.

Originally posted this article Binance

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.