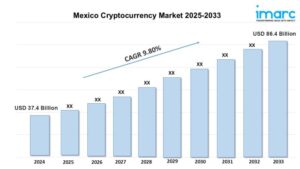

By 2033, the size of the Mexican cryptocurrency market is anticipated to reach USD 86.4 billion.

Overview of the Mexican Cryptocurrency Market

Base Year for Market Statistics: 2024

Forecast Years: 2025–2033 Historical Years: 2019–2024

2024 Market Size: USD 37.4 Billion

2033 Market Prediction: USD 86.4 Billion

9.80% is the market growth rate for 2025–2033.

In 2024, the value of the Mexican cryptocurrency market was USD 37.4 billion. According to IMARC Group’s forecast, the market would increase at a compound annual growth rate (CAGR) of 9.80% from 2025 to 2033, reaching USD 86.4 billion.

Mexican Cryptocurrency Market Trends:

The market for cryptocurrencies in Mexico is expanding quickly due to rising acceptance and improvements in regulations. For cross-border payments, cryptocurrencies like Bitcoin and stablecoins are becoming more popular due to a tech-savvy populace and large remittance inflows. By enacting laws to stop money laundering and promote innovation, the Mexican government has adopted a balanced strategy. Large exchanges that control the Latin American industry, like as Bitso, have increased their offerings and made it simpler to access digital assets.

Additionally, interest in NFTs and decentralized financing (DeFi) is growing, especially among younger investors. Security issues and volatility, however, continue to be problems. Mexico’s dedication to digital finance is further demonstrated by the Central Bank’s digital peso effort. Mexico’s cryptocurrency economy is well-positioned as more companies take cryptocurrency payments and blockchain technology becomes integrated into industries like banking and logistics.for sustained growth, positioning the country as a key player in Latin America’s digital economy.

Mexican Cryptocurrency Market Scope and Growth Analysis:

Analysis of the size and growth of the cryptocurrency business in Mexico shows that it is a quickly growing industry propelled by rising digital use, remittance needs, and regulatory developments. Mexico has become a major player in the crypto economy of Latin America thanks to its tech-savvy populace and high smartphone penetration rate. Rising inflation and the demand for alternative financial solutions are driving the market’s expansion, attracting more companies and individuals to stablecoins like Ethereum and Bitcoin

To keep up with demand, major exchanges like Bitso, which controls the Mexican market, and international firms like Binance are growing their services. Forecasts indicate steady growth, bolstered by institutional interest and blockchain innovation, despite obstacles such as volatility and inadequate financial integration. With possible advancements in DeFi, NFTs, and Web3 applications, the cryptocurrency market is positioned to play a significant part in determining Mexico’s financial destiny as the nation adopts digital finance.

Mexican Cryptocurrency Industry Segmentation:

The market study provides a thorough examination of each segment, emphasizing those with the biggest market shares for cryptocurrency in Mexico. For the following parts, it contains historical data from 2019–2024 as well as projections for the years 2025–2033.

The report has segmented the market into the following categories:

Type Insights:

• Bitcoin

• Ethereum

• Bitcoin Cash

• Ripple

• Litecoin

• Dashcoin

• Others

Component Insights:

• Hardware

• Software

Process Insights:

• Mining

• Transaction

Application Insights:

• Trading

• Remittance

• Payment

• Others

Regional Insights:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.