ETH Price Outlook: Rally Builds on SEC Chair Atkins’ Pro-DeFi Remarks

Ethereum (ETH) rose 3% during early Asian trading on Wednesday, buoyed by positive sentiment following recent comments from U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler on decentralized finance (DeFi) regulation.

Atkins’ Supportive Stance on DeFi Fuels Ethereum’s Rally

The price of Ethereum surged more than 10% from a Monday low of $2,490, briefly hitting $2,820 — its highest level since February 24. The rally followed Atkins’ remarks during the final 2025 session of the SEC’s Crypto Task Force roundtable, where he laid out an optimistic vision for the future of DeFi.

Atkins praised the SEC’s Division of Corporation Finance for clarifying that staking, staking-as-a-service, and proof-of-work models do not fall under current securities laws. He also emphasized the reliability of smart contracts within DeFi systems and underscored the need for regulatory frameworks tailored to on-chain services.

He identified three potential paths for DeFi regulation: issuing new guidance, amending existing SEC rules, and allowing for “innovation by exemption” — a flexible approach to support emerging technologies.

Ethereum Benefits from Broader Market Tailwinds

Atkins’ remarks come as Ethereum also gains attention amid growing interest in stablecoins. Circle’s recent success on the NYSE and progress on the GENIUS stablecoin bill in the U.S. Senate have added to the bullish backdrop.

“Looking ahead, macro tailwinds are aligning for ETH,” analysts at QCP wrote in a Tuesday investor note. “Ethereum’s integral role in tokenization and settlement systems positions it for significant structural growth.”

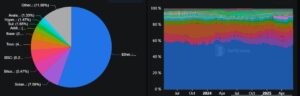

Ethereum remains the dominant platform in both the DeFi and stablecoin ecosystems, securing over 55% of total value locked (TVL) and 50% of global stablecoin supply, according to data from DeFiLlama.

The recent developments have ignited strong bullish momentum in Ethereum derivatives, with futures funding rates surging to their highest level since May 23, according to Coinglass. This spike triggered $128.38 million in futures liquidations over the past 24 hours — $48.07 million from long positions and $80.31 million from shorts.

Trading activity in ETH derivatives has also picked up significantly, with futures and options volumes jumping 46% and 51%, respectively.

“Implied volatility on Ethereum has increased, with near-term at-the-money volatility climbing into the low 70s,” noted analysts at QCP. “Meanwhile, options skew has sharply shifted toward calls, rising by 5 to 6 points. Elevated perpetual funding rates further support the bullish sentiment.”

Ethereum staking activity mirrors this positive trend, with the total balance across staking protocols reaching a record high of 34.59 million ETH, based on data from Beacon.ch.

U.S. spot Ethereum ETFs have extended their winning streak, marking 18 consecutive days of net inflows. In contrast, spot Bitcoin ETF flows have shown more variability.

“This shift indicates a broader investment narrative taking shape — moving from viewing Bitcoin as digital gold to recognizing Ethereum as the foundational infrastructure for real-world asset tokenization,” analysts observed.

Ethereum Price Outlook: ETH Targets $3,250 Amid Key Resistance Test

Ethereum has broken above a rising trendline and the 200-day Simple Moving Average (SMA), overcoming a major barrier that has capped gains since May 13.

With this breakout, ETH is now challenging the upper boundary of the $2,750 to $2,850 resistance zone. If the 200-day SMA holds as a support level, Ethereum could push above $2,850, regain the critical $3,000 mark, and potentially climb toward the next resistance near $3,250.

On the downside, if Ethereum fails to hold above the 200-day SMA, the rising trendline may offer the next level of support. A deeper pullback could shift attention to the $2,400–$2,500 support zone.

Technical indicators reflect growing bullish momentum. The Relative Strength Index (RSI) has moved above its moving average and is approaching overbought territory, suggesting increasing buying pressure. At the same time, the Moving Average Convergence Divergence (MACD) is testing its signal line, with histogram bars nearing a bullish flip. A confirmed crossover would further reinforce the positive trend.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.