Ethereum Price Outlook: ETH investors return to buying as ETF inflows surge and exchange reserves dwindle

Ethereum (ETH) briefly crossed above $2,600 on Monday following a switch to accumulation in the top altcoin’s exchange reserve and $583 million in inflows into ETH investment products last week.

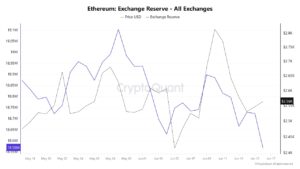

Ethereum exchange reserves have reached an unprecedented low of 18.57 million ETH, down from 18.72 million ETH on Saturday, prompting a return to bullish activity for the cryptocurrency on Monday. The decline in the total value of exchange reserves indicates an increase in demand for foreign currency

Beaconcha.in data indicates that ETH’s total staked value increased by 80K ETH during this period, reflecting a heightened bullish sentiment among investors.

According to CoinShares data, the move toward ETH accumulation comes after a week of robust institutional buying pressure that drove net inflows in global Ethereum products to $583 million last week.

The buying impetus came from $528.12 million in inflows into US spot ETH exchange-traded funds (ETFs), marking their best weekly performance since December 2024. The products experienced a 19-day stretch of net inflows before the streak ended on Friday, with mild outflows of $2.18 million occurring in the wake of heightened tensions in the Middle East.

Tracy Jin, COO of crypto exchange MEXC, stated, “Ethereum’s recovery is bolstered by the ‘digital oil’ narrative and ecosystem fundamentals, such as the Pectra upgrade and rising stablecoin activity, with nearly 50% of all stablecoins on the Ethereum network.”

She added, “It’s also good to see the rules regarding staking and new stablecoin-related ETFs coming into effect, as this is helping to boost investor confidence.”

Despite recent favorable developments regarding ETH, Jin maintained a cautious prediction for ETH’s price by the end of the year.

According to Jin, “ETH may range from $2,800 to $3,600 by year’s end, with potential for even greater heights if ETF staking and network advancements accelerate.”

Ethereum Price Forecast:

According to Coinglass data, Ethereum saw $134.04 million in futures liquidations over the past 24 hours, with long and short liquidations amounting to $70.55 million and $63.49 million, respectively.

Over the weekend, ETH maintained support close to $2,500 and encountered the 200-day Simple Moving Average (SMA), which acted as dynamic resistance before it was rejected. If the top altcoin turns the 200-day SMA support, it could test the key resistance at $2,850. If a rejection occurs at $2,850, it will indicate a double-top formation.

However, if the support at $2,500 fails, ETH must maintain the lower boundary of a crucial channel bolstered by the 50-day SMA to avert a drop to the support range of $2,260 to $2,110.

The Relative Strength Index (RSI) is positioned above its neutral level and may test its moving average line, whereas the Stochastic Oscillator (Stoch) is situated below its neutral level. A successful crossover in both indicators above will bolster the bullish momentum.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.

.