GameStop Increases Treasury Reserves’ Bitcoin Holdings

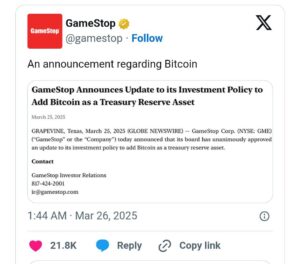

The company’s headquarters in Grapevine, Texas, made the announcement public on March 25, 2025. For the retail behemoth, which has been navigating rough seas lately, it marks a dramatic change.

GameStop, a well-known brand among investors and gamers, said that the modification to its investment strategy was unanimously accepted by its board.

GameStop Bets on Bitcoin for Future Stability

This action places Bitcoin in the company’s financial reserves alongside more conventional assets. The quantity of Bitcoin that GameStop intends to purchase was not made clear in the press statement, but the move highlights a rising trend in which businesses are diversifying their holdings with digital assets.

GameStop’s decision to use Bitcoin as a treasury reserve asset is an obvious example of their innovative thinking. GameStop seems to be among the numerous businesses searching for methods to hedge their bets in light of the impending inflation and economic uncertainties.

By adopting Bitcoin, the business is placing a significant wager on the cryptocurrency’s future in the hopes of capitalizing on its growing popularity and worth. GameStop has previously garnered media attention for its audacious financial decisions. Its a 2021 meme stock frenzy fueled by retail investors on platforms like Reddit. This turned the company into a Wall Street darling virtually instantly.

More About GameStop

GameStop Corp.’s stock experienced a notable increase in pre-market trading after the company’s announcement on March 25, 2025. The market seemed to support the company’s decision to include Bitcoin in its financial strategy, as traders expected to profit from the cryptocurrency’s increasing popularity.

This spike in interest is consistent with GameStop’s track record of drawing notice through unorthodox business tactics. For instance, its 2021 rise in meme stocks. GameStop’s stock price increased significantly, as the graphic illustrates. reaching a top of $28.79 by March 25, 2025, after rising from about $25.00.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.