How Elastos uses The growing role of Bitcoin in DeFi

RESEARCH: BTCFi is making Bitcoin a DeFi powerhouse.

Elastos secures ~50% of BTC’s hash rate and enables trustless lending, BTC-backed stablecoins, and cross-chain transactions via BeL2.

Compared to Stacks & Rootstock, it offers full EVM compatibility, institutional adoption, and DID solutions, positioning it as a leader in Bitcoin DeFi.

The growing role of Bitcoin in DeFi

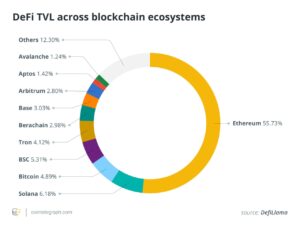

Ethereum has historically led DeFi, holding more than half of the $175 billion total value locked (TVL) in the industry. Nonetheless, Bitcoin is a desirable platform for DeFi innovation due to its robust security and liquidity.

Despite its strengths, Bitcoin’s lack of native smart contract functionality has historically limited its role in decentralized finance. The emergence of Bitcoin-centric DeFi solutions aims to bridge this gap and enable Bitcoin holders to participate in lending, stablecoin issuance and crosschain interoperability without custodial risks.

Elastos: Using the security of Bitcoin for decentralized apps

Because it uses merged mining, which enables secondary blockchains to inherit Bitcoin’s security, Elastos stands out as one of the pioneers in this progression.

The platform is positioned as one of the most computationally resistant Bitcoin-linked networks since Elastos is secured by around half of Bitcoin’s 800 EH/s hash rate. This guarantees that Elastos-based financial apps uphold a security standard comparable to that of Bitcoin.

The Elastic Consensus model, a hybrid method that combines bonded proof-of-stake, proof-of-integrity, and auxiliary proof-of-work, is the foundation of Elastos’ infrastructure.

This multi-layered strategy increases Elastos’ attractiveness for DeFi applications while allowing it to offer safe, scalable financial services. To guarantee smooth integration with the larger DeFi ecosystem, the Elastos Smart Chain, an Ethereum Virtual Machine-compatible sidechain, makes it easier to create decentralized applications (DApps).

BeL2: An innovation for BTCFi

The BeL2 Arbiter Network, which aims to integrate trustless Bitcoin transactions into DeFi, is a significant focus of the research. Without depending on centralized custodians, BeL2 uses zero-knowledge proofs (ZKPs) to validate Bitcoin transactions on the Ethereum and Elastos networks.

This technique solves a long-standing issue in BTCFi and enables the usage of Bitcoin in DeFi protocols without the need for intermediaries or synthetic assets.

Institutions are already interested in this model. A project headed by Harvard University students and alumni is using BeL2 to create a stablecoin backed by Bitcoin. Additionally, the platform facilitates decentralized lending, which enables Bitcoin owners to use stablecoins as collateral for loans while still being exposed to the growth of the cryptocurrency’s value.

The market situation and prospects of Elastos

Stacks and Rootstock are two well-known Bitcoin DeFi solutions that compete with Elastos’ BTCFi strategy. Bitcoin finality is the main advantage of Stacks, Rootstock concentrates on EVM compatibility, and Elastos sets itself apart by fusing crosschain interoperability with strong security (via merged mining). This makes Elastos a powerful force in the BTCFi market.

Adoption of Bitcoin DeFi presents both potential and challenges.

Bitcoin-secured assets are anticipated to be crucial in transforming both traditional and decentralized finance as the blockchain sector moves toward crosschain interoperability and decentralized governance.

The goal of Elastos’ inventions is to improve the security, scalability, and institutional acceptance of Bitcoin in DeFi, especially with BeL2 and its decentralized identity (DID) framework.

Given the anticipated large growth in Bitcoin-secured banking, Elastos’ infrastructure offers a strong basis for the upcoming generation of decentralized financial apps.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.