Pi Network Price Prediction: Pi Coin drops 54% in a week, yet analysts forecast a 250% increase.

Pi Network’s value declines

Pi System Pi 10.46% for the Pi Network

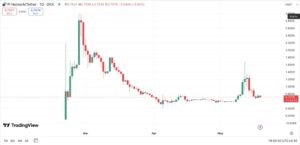

Among the top 100 cryptocurrency assets, Pi Network has seen the largest weekly reduction, falling 54% in the last week.

The drop came after a brief rally in which Pi coin shot up 106% in a single day, from $0.78 on May 11 to a peak of $1.61 on May 12.

The decision was primarily prompted by early indications of a significant ecosystem update and excitement for Pi Network’s impending presentation at Consensus 2025.

But the momentum was soon lost.Attitude changed after a $100 million ecosystem fund was announced on May 14–15. Despite its size on paper, the announcement was not widely seen as a significant turning point, but rather as just another delay in actual network access.

Consequently, the price dropped to $0.68 on May 18, which was almost 58% lower than the peak on May 12. PI is currently trading at about $0.71 as of this writing on May 19, which represents a slight 4.4% rebound from the most recent low.

Furthermore, the continuous KYC restrictions and absence of exchange listings limit trading activity, making the price more susceptible to volatility driven by perception.

Now, let’s take a closer look at Pi Network’s existing ecology, recent structural and technical problems, and the kind of price action that is likely to occur in the next days.

What was the actual outcome of Pi Network?

Several statements made by Pi Network over the previous month were anticipated to signal a sea change in the project. Rather, they presented more queries than responses.

In order to build anticipation that the long-awaited decentralized applications would finally materialize, the core team has previously alluded to a significant ecosystem milestone set for May 14.

There were some advancements. As part of the Horizon upgrade, Pi Network finished shutting down its final central node in early May. This was presented as a decentralization step, supporting previous assertions that the technology was ready for complete network autonomy.

To be more transparent, the team also hinted at plans to open-source its codebase, something that the community has been asking for for years.

To make the app more accessible, Pi teamed up with Banxa to incorporate fiat onramps, which let users purchase PI with conventional payment methods like credit cards and Apple Pay or Google Pay.

Interestingly, customers could access this service before completing the in-app know-your-customer procedure. Although this made it easier to enter the ecosystem, the token itself did not gain any real utility as a result.

The establishment of Pi Network Ventures, a $100 million investment fund dedicated to promoting ecosystem development, was the main news made on May 14.

In addition, the group proposed the idea of a “ownerless” Pi Foundation, which would serve as the network’s long-term governance.

Despite the structural significance of both programs, neither one provided a schedule for the release of broadly applicable applications. This represented yet another setback for consumers who had been mining Pi for years in anticipation of practical applications.

This is particularly pertinent in light of previous recommendations. The team proposed in February that the Open Network debut will be accompanied by more than 100 decentralized applications.

There are currently very few functional applications available, with the exception of test events like a Pi domain name auction or a small-scale shopping festival. Timelines for the launch of that larger app ecosystem are unclear.

Pi’s participation at the Consensus 2025 conference was met with even more disappointment. Dr. Nicolas Kokkalis, the founder, gave a keynote address about long-term goals integrating decentralized finance, digital identity, and artificial intelligence.

He did not, however, offer a schedule or a roadmap, so many participants and community members were unsure about what to do next.

Allegations, confusion, and a trust gap

In addition to Pi Network’s price plummeting during the past week, there has also been a noticeable decline in user confidence. On sites like Discord and X, community mood became overtly critical as the price dropped.

Longtime Pi users, referred to as “Pioneers,” started to express worries that the project was being purposefully delayed with little attempt to offer actual access or utility.

Additional accusations added to these tensions. A Pi-focused community analyst named Dr. Picoin, an X user, shared blockchain pictures on May 17th, stating that 12 million PI tokens were transferred from a wallet connected to the Pi core team just before the token’s most recent peak.

At a time when the community’s attention was focused on the project’s announcements, he proposed that this might be an example of an insider token sale.

It was implied that key contributors might have sold their interests at high prices before the general public could respond.

The timing raised concerns, even if the assertions have not been proven. Some members of the community had previously recognized the wallet address in question, GABT7EMP, as a common distribution or migration wallet that was used to move balances from the testnet to the mainnet.

Some advocates of Pi retaliated, claiming that the accusations were falsely derived on a misinterpretation of blockchain data.

In a subsequent, longer statement, Dr. Picoin listed several complaints from the viewpoint of the community. He emphasized the irregularities in the KYC rollout since 2021, the failure to honor referral-based benefits, and the several delays in the Open Network launch, which was eventually launched in February 2025.

The Pi Core Team’s Latest Move Leaves Pioneers Behind

The recent launch of Pi Network Ventures has sparked frustration across the community—and for good reason. After six years of dedication, mining, promoting, and waiting, Pioneers expected a thriving ecosystem. Instead, we have learned that most of the promised 100 DApps still do not exist, and a 100 million dollar fund will now be used to build them.

Broken Promises, One After Another:

1. Most Pioneers never earned over 1000 Pi—not due to inactivity, but because referral rewards were never credited, and Ambassador bonus promises were quietly ignored.

2. KYC began in 2021. We embraced it and prepared for mass onboarding. But what followed were repeated delays, each with changing justifications.

3. The Open Network was promised almost every quarter since 2022, with constant hints that launch was just around the corner. Yet it took another three years to arrive—finally launching in 2025. By then, the excitement had faded, and the milestone had lost meaning.

4. One of the main reasons given for delaying the Open Network was the need to meet three core conditions—one of which was having 100 real Pi apps live or Mainnet-ready.

But todays announcement makes one thing painfully clear: even after six years—and despite the Open Network finally launching—most of those apps still do not exist. Now, the Core Team plans to use part of the 100 million dollar fund—value generated through the sweat, belief, and patience of the Pioneer community—to finally build what should have already been in place.

So what happened to the millions generated from years of in-app ad revenue? And what about the hackathons—were they not meant to incubate and launch these very DApps?

Too many questions. And as always—no real answers.

Trust Is Fading

Just days ago, the Core Team hyped a major ecosystem announcement, briefly pushing Pi value higher. But once the news dropped, Pi fell to 0.80 dollars—clear proof the announcement did not meet expectations. If it had, the market would have reacted with confidence, not disappointment.

We Deserve Better

Pioneers built this network. We are not just users—we are the foundation. It is time the Core Team delivers with real transparency, accountability, and respect for the community that made Pi what it is.

It raises the question of how previous hackathons and ad income were used, he said, and the latest $100 million Pi Ventures fund is now being portrayed as a mechanism to construct the 100 DApps that were originally promised years ago.

Concerns about censoring were brought up by other community members. In one instance, a user asked why wallet mapping and exchange access were prohibited in mainland China and claimed to have been blocked from a Pi community channel.

The Pi Core Team has not yet clarified the disputed wallet behavior or responded to the accusations in an official manner. At this point, all interpretations are unverified claims, and nothing has been independently validated or confirmed.

Pi Network price prediction

Pi is currently trading at about $0.71 after a recent dip. Many holders are currently wondering if this price will rebound and, if so, how quickly and how far.

CoinCodex predicts that the price may rise by 33.4% from its present levels to $0.947 over the next five days.

In the future, the 1-month forecast indicates a target price of $2.38, which would represent a 235% gain over the current price. At $2.51, the 3-month forecast is somewhat higher and shows a possible gain of 253.5% from $0.71.

CoinCodex’s longer-term forecasts for 2025 and 2026 are comparable. According to the platform, Pi might trade between $0.728 to $3.43 in both years. PI would increase by 382% from its current value if it were to hit $3.43.

It’s crucial to remember that these ranges are still purely hypothetical and mostly reliant on developments in user uptake, exchange listings, and network usefulness.

DigitalCoinPrice provides a more cautious prediction. It predicts that Pi’s price will climb by about 119.7% from its present levels to an average of $1.44 in 2025, with a possible top of $1.56.

It is projected to peak at $1.84 in 2026, a 159% increase from the current value. According to the platform, growth will continue until 2030, and by the end of the decade, Pi might even hit $3.90.

Notwithstanding these hopeful forecasts, none of the models take into consideration exchange limits, regulatory obstacles, or unsubstantiated allegations that can affect investor confidence.

Pi Network does not yet have a completely functional trade ecosystem. Any forecast is extremely unclear until that changes because market access and real-world value are still restricted.

As with any new cryptocurrency, prudence is crucial. Pi Network has yet to demonstrate its long-term sustainability, and investment decisions shouldn’t be made just on the basis of Pi Network price forecasts. Never make larger investments than you can bear to lose.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.