Prices of Gold Silver and Bitcoin Rally: Which Should I Buy?

The market’s most valuable assets are gold, silver, and bitcoin, whose price movements draw in investors. Due to their disparate asset types, demand, and performance, investors are still unsure on what to purchase, particularly given the state of the market. Let’s talk about the main distinctions and potential investment locations in this blog.

Silver, Gold, and Tumbles Give Way to a Bitcoin Price Rally

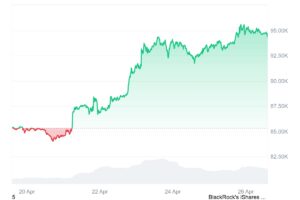

The price of gold fell this week after reaching a fresh all-time high of $3,500 only a few days earlier. On Friday, the price dropped by over 2% to $3,282/oz. Interestingly, the decline occurred after the effects of the trade war between the US and China subsided. The price of Bitcoin started to increase at the same time, rising 10% during the week to $94,190.

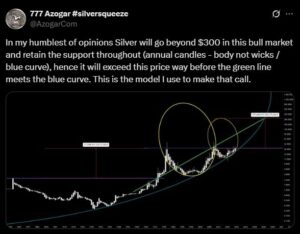

Lastly, the Silver price also took a toll, currently trading at $33.34. Compared to the other two, its impact and demand are much lower due to restricted price performance. Although market experts like Robert Kiyosaki boost Silver demand, it’s nowhere in comparison to Gold and Bitcoin, leaving them to battle against each other.

Interestingly, the community believes Silver would hit $38 next and $300 in a bull market, whereas the targets for Bitcoin are above $200,000, and Gold to new highs.

Bitcoin Vs Gold Price Prediction: What’s Coming Next?

Despite Gold’s price dip, it is up more than 25% in YTD, becoming one of the best-performing assets. Although the overall look for this is bullish, experts like Sneha anticipate Gold’s potential drop to $2,500-$2,600 before recovering. JP Morgan adds that it could surge to $4,000/oz.

As a result of improved tariff updates and growing investor confidence, there is less demand for gold, which is why it is declining.

Due to the Trump trade battle, Bitcoin has drastically dropped from its previous all-time high of $109,114. It has managed to become the world’s fifth-largest asset in spite of this. Experts predicted that the price of Bitcoin will rise above $200,000 by the end of the year based on historical data and the rebound of the past few days.

More significantly, ARK Invest’s Bitcoin price forecast, which takes into account the surging inflows into Bitcoin ETFs, the US strategic reserve debate, and growing usage, projects a $2,400,000 target for the currency.

Which should I purchase?

Given that a diverse portfolio is advised by experts like Robert Kiyosaki, all three assets are ideal to purchase. While gold’s long-term use case, gold reserve, and steady performance make it desirable, Bitcoin’s scarcity, profitability, adoption, and performance make it desirable. Investors might make a purchase decision based on the use case.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.