The SEC-approved XRP ETF is scheduled to launch on April 30.

April 30 is the official debut date. Both institutional and individual investors are intended users of the ETFs. They provide fresh opportunities to learn about XRP without actually owning the token.

This ruling comes after Ripple’s well-publicized legal spat with the SEC concluded. XRP’s regulatory position was long shadowed by the XRP ETF issue.

A Trio of New XRP Funds

Three leveraged and inverse XRP ETFs are being introduced by ProShares:

The Ultra XRP ETF provides twice-daily exposure to the price of XRP.

The short XRP ETF is made to move in the opposite direction of the price of XRP, so it gains when it declines.

The Ultra Short XRP ETF doubles down on short moves and provides -2x exposure.

Sophisticated investors looking to hedge holdings or increase returns are the target market for these cryptocurrency ETFs. They do, however, carry a higher danger. Leverage, for instance, increases both earnings and losses.

However, ProShares is not the pioneer. Teucrium introduced the first-ever XRP ETF in the United States earlier this month. The 2x product saw trading volume of over $5 million on its first day. It was dubbed the company’s “most successful launch” to yet. The achievement shows that investors are becoming more interested in structured exposure to cryptocurrencies other than Bitcoin and Ethereum.

More About XRP ETFs

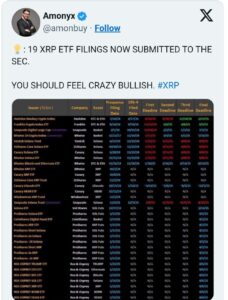

The SEC has already received 19 XRP ETF registrations, indicating a sharp increase in interest from fund managers wishing to provide XRP-based investment products.

Both leveraged and spot ETFs are included in these filings, and the companies are keen to give investors new options for XRP exposure. The increasing volume of applications suggests a move toward more extensive institutional and retail access to XRP through exchange-traded funds, even though the SEC has not yet approved a spot XRP ETF.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.