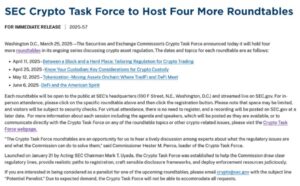

SEC Crypto Task Force roundtables scheduled between April 11 and June 6

Here’s a structured breakdown of the SEC’s Crypto Task Force roundtables scheduled between April 11 and June 6, covering critical topics like regulation, custody, tokenization, and DeFi:

Key Details

- Host: SEC’s Crypto Assets and Cyber Unit (Enforcement Division’s specialized task force).

- Format: Four roundtables (likely private or semi-private discussions with industry players, regulators, and legal experts).

- Topics:

- Regulation (likely focusing on clarity around securities vs. commodities, compliance frameworks).

- Custody (potential updates to rules for crypto asset safekeeping, including qualified custodians).

- Tokenization (RWA tokenization, securities laws applicability, and institutional adoption).

- DeFi (regulatory gaps, AML risks, and how to oversee decentralized protocols).

Why This Matters

- Enforcement vs. Guidance: The SEC has aggressively pursued crypto firms (e.g., Coinbase, Uniswap lawsuits), but these roundtables suggest a possible shift toward dialogue—or at least a PR effort to counter criticism of its “regulation by enforcement” approach.

- Political Timing:

- Election Year Pressure: The SEC may be softening its stance amid bipartisan push for crypto legislation (e.g., FIT21, SAB 121 repeal).

- Global Competition: The EU’s MiCA, UK’s stablecoin rules, and Hong Kong’s crypto hub ambitions are forcing U.S. regulators to act.

- Industry Impact:

- Custody: Could signal changes to Rule 15c3-3, affecting broker-dealers and institutional crypto services.

- Tokenization: Clarity could accelerate Wall Street adoption (e.g., BlackRock’s BUIDL, Franklin Templeton’s blockchain fund).

- DeFi: Potential for first-ever U.S. regulatory framework targeting decentralized protocols (or more enforcement).

What to Watch

- Participants: Will crypto critics (e.g., Elizabeth Warren) or pro-innovation voices dominate?

- Follow-Up Actions: Will these roundtables lead to proposed rules, or are they just optics?

- SEC Chair’s Role: If Paul Atkins is confirmed, his crypto ties could influence the task force’s direction.

Bottom Line

This is the SEC’s chance to clarify its crypto stance—or double down on enforcement. Either way, the outcomes will shape 2024’s regulatory landscape.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.