The cryptocurrency industry market capitalization surpassed $4 trillion in a crucial week.

Reuters, July 18. According to CoinGecko, the market capitalization of the cryptocurrency industry reached $4 trillion on Friday, a significant milestone that illustrates how it has evolved from a relatively new asset class to a key component of the global investment landscape.

The crypto industry has reached a new value peak due to a combination of increased institutional flows, legal certainty in important markets, and a wave of renewed excitement.

A plan to establish a regulatory framework for cryptocurrency tokens, or stablecoins, that are pegged to the US dollar was approved by the US House of Representatives on Thursday. President Donald Trump is anticipated to sign the bill into law.

Lawmakers are still being cautious, even though the Trump legislation marked a change in sentiment toward the cryptocurrency sector, according to Derren Nathan, head of equity research at Hargreaves Lansdown.

Two further cryptocurrency legislations were also approved by House legislators and will now be sent to the Senate for review. While one aims to prevent the United States from launching a digital currency issued by a central bank, the other lays out a regulatory framework for cryptocurrencies.

The $4 trillion milestone highlights the progress made by the cryptocurrency industry since its fringe, speculative beginnings. Digital assets are influencing discussions in international finance more and more as a result of new exchange-traded products, greater interest from asset managers, and wider adoption among corporate and retail users.

Crypto traders frequently utilize stablecoins, a kind of cryptocurrency created to preserve a value, typically a 1:1 dollar peg, to transfer money between tokens. Proponents claim that they may be used to make payments instantaneously, and their use has increased in recent years.

Chris Perkins, president of CoinFund, stated, “The Genius Act will be remembered as a law that led to the mainstreaming of cryptocurrency as an asset class.”

As more and more publicly traded firms include bitcoin on their balance sheets as a long-term store of value, corporate treasury allocations to the cryptocurrency are also increasing.

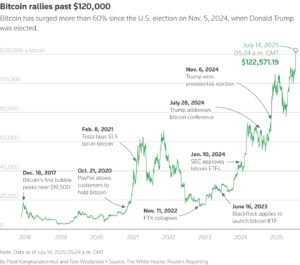

When bitcoin, the biggest cryptocurrency in the world, dropped 1.8%, the sector’s combined market value was $3.92 trillion.Earlier this week, Bitcoin broke beyond the $120,000 barrier. By the end of 2025, brokerage firm Bernstein said it may reach $200,000.

The second-largest cryptocurrency, Ether, had a 4.5% increase. In the last three months, it has more than doubled.

Coinbase (COIN.O), opens new tab, and Robinhood (HOOD.O), opens new tab, both reached all-time highs on Friday, driven by the cryptocurrency boom.

The retail trading platform, which also facilitates cryptocurrency deals, saw a 3% increase in value, while the cryptocurrency exchange’s shares were up 1%.

Broad gains were also seen in ether-focused stocks.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.