The Most Recent Ethereum Price Forecast Indicates That ETH May Reach $15K by 2025

The price of Ethereum (ETH) has risen above $3,800 due to significant institutional buying, but traders are harshly criticizing the rally because they believe the gains are unsustainable.

Due to unprecedented inflows into spot ETH exchange-traded funds and what analysts refer to as enormous whale accumulation, the second-largest cryptocurrency in the world surged by about 6% in the last day and more than 25% over the week.

For the ninth straight session, Ethereum has increased, hitting its highest levels in seven months. Now, traders want to know why Ethereum is rising. This article presents the most recent Ethereum price forecasts and examines the causes of the increase.

Ethereum Price Today Rises for 9th Straight Session, Hits 2025 High

With the cryptocurrency breaking past significant barrier levels, the price of Ethereum today exhibits tremendous positive momentum. Traders have been keeping a careful eye on the $3,800 mark, which represents a key psychological barrier. Technical analysts point out that Ethereum’s performance has surpassed that of the CoinDesk 20 Index, indicating that the second-largest cryptocurrency has selective strength.

The price of Ethereum hit an intraday high of $3,812 during the Monday session on July 21, 2025, which was the highest figure since December 2024, which was seven months ago. ETH is currently testing the $3,800 barrier level after riding a nine-day winning streak.

Ethereum had its best monthly performance in three years last week, up more than 26%, and is up more than 50% for July.

Fundstrat’s Mark Newton believes ETH could potentially reach $4,000 before July ends based on technical chart patterns. The current price action shows Ethereum testing multi-month highs while maintaining strong volume support, indicating genuine buying interest rather than speculative froth.

Why Is Ethereum Going Up?

Ethereum’s momentum is increasing due to a number of factors. According to Tom Lee of Fundstrat Global Advisors, Ethereum is “Wall Street’s preferred choice” for blockchain infrastructure and might hit $15,000 in the medium run. Lee cited Robinhood’s tokenization initiatives and JPMorgan’s stablecoin as proof that traditional banking is supporting Ethereum over rivals.

Among the main factors contributing to Ethereum’s rise is its unparalleled institutional adoption; last week, during what traders nicknamed “crypto week” because of significant legislation passing, U.S.-listed spot ether ETFs brought in a record $2.18 billion. Because demand is greater than supply, this enormous inflow of cash has driven Coinbase’s ETH reserves close to all-time lows.

“Layer-1 platforms like Ethereum, because they power entire ecosystems, often warrant higher valuation multiples, similar to how software firms command richer pricing than consumer businesses,” Lee stated.

Technical Analysis Suggests Ethereum May Test the $4,000 Level

My technical analysis indicates that the ETH/USDT pair has recently crossed above a long-term trendline that was derived from the highs of 2021. This breakthrough opens the door for a possible test of the psychologically important $4,000 level as well as the upper limit of the consolidation zone that has been developing since early 2024.

The 76.8% Fibonacci retracement of the 2021–2022 downturn, which has already denied price increases three times, is one of the main resistance points that this zone combines.

Therefore, even though Ethereum’s current surge is still robust and has potential to grow, a more pronounced bearish reaction could be triggered by touch with the $4,000 barrier.

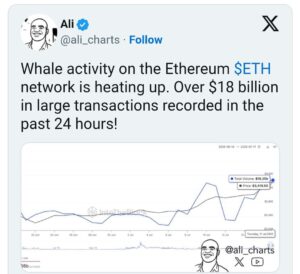

Whale Activity Signals Confidence

Over the weekend, one whale amassed $50 million worth of Ethereum at an average price of $3,714, according to data from on-chain trackers. According to a separate analysis by cryptocurrency expert Ali Martinez, Ethereum whales purchased almost 500,000 ETH in just two weeks, indicating that huge holders are quietly confident.

Historically, significant price changes or changes in the ecology have been preceded by this whale buying activity. Sophisticated investors are planning for longer-term gains rather than short-term trading earnings, according to the accumulation pattern.

Ethereum Short Squeeze Looms

Many traders are still pessimistic about Ethereum’s future despite the buying frenzy. On social media, Crypto Banter referred to it as “the most hated rally right now” and pointed out the atypically high short positioning.

If ETH reaches $4,000, as technical analysis indicates could happen shortly, data from CoinGlass indicates that almost $331 million in short positions could be liquidated. As forced buying pushes prices even higher, this liquidation cascade would probably exacerbate price momentum in a traditional feedback loop.

Corporate Treasury Trend Emerges

The rise of publicly traded corporations implementing Ethereum treasury techniques is a new factor driving pricing. Large-scale ETH purchases have been made by companies like Bitmine Immersion Technologies and SharpLink Gaming, whose stocks have increased by 400% after revealing their crypto strategy.

With these “ETH treasury companies that are only a month old” “competing to get 1% of the supply each,” according to trader Pentoshi, structural demand is being created that wasn’t there in earlier cycles. This pattern of business adoption is similar to that of Bitcoin in 2020–2021; however, it is occurring more quickly with Ethereum.

Ethereum Price Predictions: Analysts Target $15-20K

Short-Term Ethereum Price Prediction (July-August 2025):

- Fundstrat’s Mark Newton: $4,000 by end of July

- Technical resistance levels: $4,200-$4,500 range

- Conservative estimates: $3,900-$4,100 consolidation

Medium-Term Ethereum Price Prediction (Q4 2025):

- Tom Lee (Fundstrat): $10,000-$15,000 range possible by year-end

- Colin Talks Crypto: $15,000-$20,000 in current bull cycle

- Moderate forecasts: $6,000-$8,000 by December 2025

Long-Term Ethereum Price Prediction (2025-2026):

The EBITDA model of Fundstrat: Depending on the ecosystem value, up to $15,000.

Tokenization

Growth scenario for tokenization: between $12,000 and $18,000

Adoption by conservative institutions: $8,000–$12,000

The network’s dominance in tokenized real-world assets (now over 60%), the rise of stablecoin usage, and the expanding acceptance of corporate treasury are some of the major elements that underpin these Ethereum price projections.

Ethereum Price Predictions Summary Table

|

Timeframe |

Price Range |

Key Analysts & Targets |

|

Short-Term (July-August 2025) |

$3,900 – $4,500 |

Mark Newton: $4,000 by end of July, conservative $3,900-$4,100 consolidation |

|

Medium-Term (Q4 2025) |

$6,000 – $20,000 |

Tom Lee: $10,000-$15,000 possible by year-end; Colin Talks Crypto: $15,000-$20,000 |

|

Long-Term (2025-2026) |

$8,000 – $18,000 |

Fundstrat EBITDA model: up to $15,000; Tokenization growth: $12,000-$18,000; Conservative: $8,000-$12,000 |

Fundamental Drivers Supporting Higher Prices

There is more to Ethereum’s surge than just speculation. More than 60% of tokenized real-world assets are presently hosted on the network; Lee anticipates that percentage will rise if stablecoins surpass the $2 trillion threshold, as predicted by Treasury officials. There is less liquid supply accessible for trading because over 30% of the ETH supply is still locked in staking.

Market Structure Changes

According to Benjamin Cowen, Ethereum is “capturing a disproportionate share of market flows” and acting more as Bitcoin did during earlier bull cycles, which is why altcoins are underperforming in comparison to Ethereum. Ethereum is evolving from an altcoin into a distinct class of digital assets, as seen by this structural change.

While corporate treasury adoption provides ongoing buying pressure, the rise of spot ETFs has opened up new demand avenues. These structural alterations imply that the present rise has stronger underpinnings than earlier cycles of the cryptocurrency market.

Looking past short-term price fluctuations to these underlying changes in market structure, institutional acceptance, and network value is necessary to comprehend why Ethereum is rising. Longer-term Ethereum price forecasts rely on these underlying dynamics continuing to evolve, even while the current price of Ethereum shows instant momentum.

Why Has Ethereum Surged?

Ethereum’s recent surge past $3,800 stems from several converging factors that have created a perfect storm for price appreciation. The primary catalyst has been unprecedented institutional adoption, with U.S.-listed spot ether ETFs recording $2.18 billion in inflows during a single week.

Can Ethereum Reach $10K?

Ethereum can hit $10,000 based on market fundamentals and current expert estimates. Price goals above this level have been set by several reputable analysts; some view this as a conservative estimate.

The greatest argument for prices over $10,000 is made by Fundstrat’s valuation model. The research group calculates that ETH may be worth up to $15,000 using EBITDA-based multiples that are comparable to those used for private companies like Circle. In support of this argument, Tom Lee points out that Layer-1 platforms, which power entire ecosystems, should fetch greater valuation multiples, much like software companies do for consumer businesses.

How High Will ETH Go in 2025?

Although analysts’ price projections for 2025 differ greatly, the majority of credible forecasts place ETH much above current prices by the end of the year. By December 2025, ETH might be worth between $6,000 and $8,000, according to conservative projections. These forecasts make the assumption that institutional adoption and tokenization usage will rise steadily but not rapidly.

By year’s end, moderately bullish forecasts predict between $10,000 and $12,000. This range is predicated on successful ETF expansion, ongoing corporate treasury use, and continued advancements in tokenizing conventional assets.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.