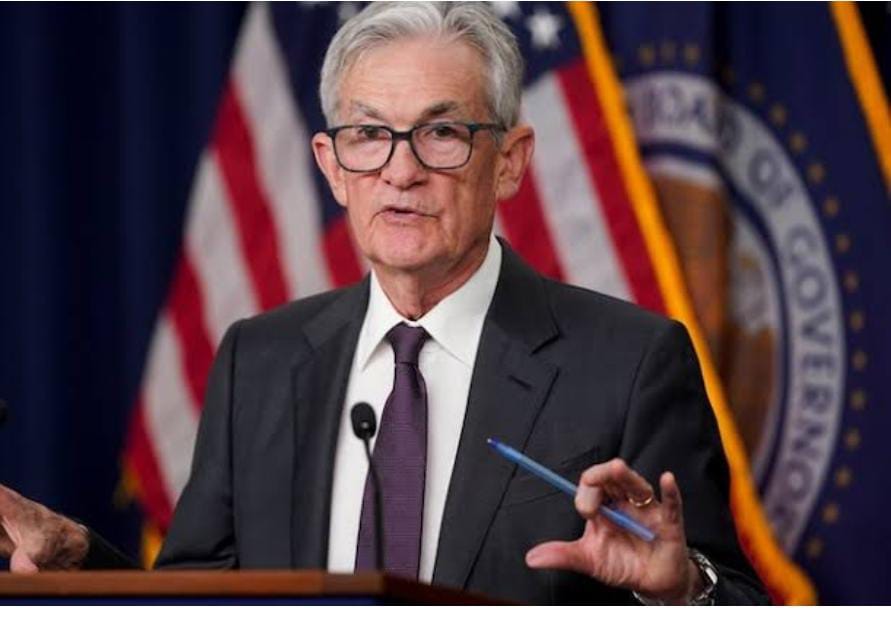

Trump tariffs, according to Fed Chair Jerome Powell, are expected to hinder US economic growth and increase inflation.

Fed Chair Jerome Powell stated Friday that the Fed will concentrate on limiting price increases to a limited level because the Trump administration’s extensive new tariffs are anticipated to cause higher inflation and slower GDP.

In his written comments, Powell stated that the tariffs’ effects on inflation and the economy are “much greater than anticipated.” Additionally, he stated that there is a “highly probable” chance that the import tariffs will result in “at least a temporary rise in inflation,” but that “it is also possible that the effects could be more persistent.”

Fed Chair Jerome Powell stated at his speech in Arlington, Virginia, “Our responsibility is to… ensure that a one-time increase in the price level does not become an ongoing inflation problem.”

Powell’s emphasis on inflation implies that the Fed will probably maintain its benchmark interest rate at 4.3% for the foreseeable future. Wall Street investors, who now anticipate five interest rate cuts this year—a figure that has grown since President Donald Trump announced the tariffs on Wednesday—are sure to be disappointed by that.

According to economists, the tariffs will increase costs, hurt the economy, and maybe jeopardize employment. In that case, the Fed may either maintain or raise rates to fight inflation or lower them to support the economy. Powell’s remarks imply that the Fed Chair Jerome Powell will prioritize inflation.

Powell’s comments follow two days after Trump announced massive tariffs that have rocked the world economy, sparked Chinese retaliation, and sent stock values down both domestically and internationally.

For the Fed Chair Jerome Powell weaker growth and rising prices are a challenging mix. In the event of weaker development, the central bank would normally decrease its key interest rate to encourage the economy and lower borrowing costs, while raising rates (or maintaining them high) to curb inflation and slow spending.

According to Kathy Bostjancic, chief economist at Nationwide, “the Fed is in a tough spot with inflation set to accelerate and the economy poised to slow.”

There was some good news on Friday when the government announced that hiring increased by 228,000 in March, although the unemployment rate increased slightly from 4.1% to 4.2%.

However, those numbers reflect recruiting that took place in mid-March, before the exact nature of the responsibilities was known. Businesses may be less inclined to invest and hire as a result of the tariffs since they have increased uncertainty about the state of the economy in the upcoming months.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.