Where the Price of Ethereum (ETH) Is Going As Solana Picks Up Speed

Before the start of altcoin season in July and August, Ethereum supremacy was at the forefront. Where will the price of Ethereum (ETH) go once it cools down?

Since then, the market dynamics have changed, with Ethereum appearing to slow off and Solana witnessing a return to supremacy.

For comparison, Solana dominance saw a remarkable 12% weekly increase last week, while Ethereum dominance just slightly increased by 1.8%.

This result had a big impact on the two cryptocurrencies’ performance. While the price of ETH increased by little over 7% over the same time period, the price of SOL saw a weekly rise of 17%.

An obvious indication that a rotation of liquidity was occurring, this time permeating the hierarchy.

The key question, though, was whether the same pattern would hold true. In that case, the price of ETH might find it difficult to surpass the $5,000 price mark.

It was important to note, though, that the price of Ethereum did benefit from this most recent bounce, rising as high as $4,768.

Despite being outshone by Solana, ETH price did demonstrate a demand resurgence from key areas.

For example, institutional demand made a solid comeback during the week, after previously experiencing a streak of outflows in the first half of the week.

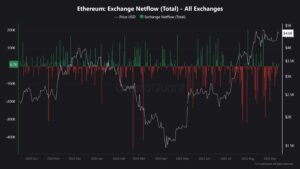

Ethereum Exchange Flows, Key Metrics Underscore Bullish Confidence For Price

The resurgence of institutional demand was also consistent with a few other Ethereum data sets. For instance, increased exchange outflows in favor of longer-term storage were shown by ETH exchange netflows.

This typically occurs when there is a strong level of long-term bullish optimism.

Staking inflows were also increasing, according to Ethereum performance statistics. This indicated growing optimism about the cryptocurrency’s long-term prospects.

One significant observation, however, was the main reason it was not all plain sailing. Concerns that validators were participating in a flight to safety were raised when the Ethereum validator exit queue recently reached all-time highs.

Additionally, several conjectured that profit-taking was the primary driver of the Ethereum validator exit queue.

Similar to how Bitcoin miners occasionally sell some of their cryptocurrency, particularly when the price sees a notable increase. As of September 13, the validator exit queue had grown to 2.6 million ETH.

Significant sale pressure could be triggered by such a large sum. The 45-day waiting period in the exit queue, however, might postpone any possible short-term sell pressure.

In fact, it might be the reason why validators are pulling their funds. They will have access in this manner as long as ETH prices are high.

Ethereum Smart Money Continues to Seek More Exposure

It’s interesting to note that demand overcame recent sell pressure. Furthermore, validators did not necessarily intend to sell right away just because they were withdrawing a sizable quantity of ETH.

Ethereum whales were also amassing the cryptocurrency, according to recent market statistics.

In recent months, addresses with more than 10,000 ETH have been actively adding to their wallets.

The whale cohort’s aggressive demand strengthened ETH’s bullish resolve. This could be the reason for the recent bearish episodes’ scarcity and their accumulation and bullish recovery characteristics.

To put it another way, whales have been using the pullbacks as a chance to buy additional Ethereum at a bargain.

When it came to network performance, Ethereum was operating as usual. Weekly net inflows into the network last week amounted to $2.5 billion.

This was higher compared to the previous 2 weeks, during which the markets experienced some uncertainty and a noteworthy Ethereum price pullback.

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.