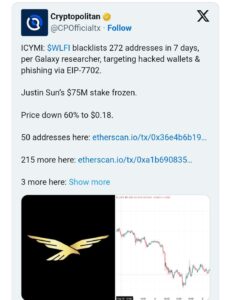

WLFI Cracks Down on Security, Blacklisting 272 Wallets

Blacklisting is the process of preventing specific wallets from sending, receiving, or exchanging tokens; this is frequently done in response to questionable conduct or platform rules violations.

The scope of WLFI’s move highlights the platform’s expanding ecosystem and its proactive attitude to user protection, even if blacklisting is not unusual in the cryptocurrency space.

Why Wallet Blacklisting Matters

Wallets are digital accounts used in the blockchain world to hold tokens and coins. A wallet loses its ability to conduct transactions on a certain platform when it is blacklisted. This action is a component of WLFI’s larger endeavor to uphold confidence and stop fraud. Although the network does not state why each wallet was included, blacklisting often targets wallets connected to money laundering, frauds, or hacking.

A broader tendency in the cryptocurrency sector is reflected in this practice. For instance, following regulatory investigation, the Ethereum-based Tornado Cash protocol was subject to similar blacklisting actions in 2023. Platforms are acting more and more to keep an eye on questionable activity and adhere to legal requirements, safeguarding both individual users and the larger financial system. Although the percentage of illegal transactions is steadily declining as platforms impose more stringent controls, crypto crime still generates billions of dollars annually, according to Chainalysis data.

The Growing Importance of Security

One component of WLFI’s security procedures is blacklisting. Additionally, the platform has made investments in automated alerts, internal audits, and monitoring systems to spot anomalous activity instantly. In addition to lowering user risk, WLFI improves platform integrity by continually monitoring wallet behavior. This indicates to investors that security is a primary concern in developing crypto ecosystems, and platforms that take decisive action typically have greater community confidence.

Additionally, the action conveys a statement about how blockchain governance is changing. Platforms are striking a balance between responsibility and decentralization as more digital assets move around the world. Proactive management can assist protect the platform and its users while maintaining the legitimacy of the token economy, as demonstrated by WLFI’s blacklisting initiative.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.