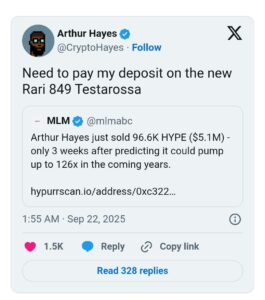

Arthur Hayes asserts that he sold hype for $800K, but he says that cryptocurrency is just going to get better.

Arthur Hayes, a co-founder of BitMEX, has sold all of his shares in Hyperliquid (HYPE). Just one month has passed since he claimed that the eleventh-largest cryptocurrency might increase by 126X. Hayes first claimed on Twitter that he had sold to purchase a Ferrari.

The well-known industry figure reportedly sold 96,628 HYPE tokens for around US$5.1 million (AU$7.7 million). As a result, Hayes received a return of about 20%, or over US$800k (AU$1.2 million).

Hype Faces “First True Test”, Says Hayes

Following his opening statement, Hayes clarified that he continues to view HYPE as a project with exceptional momentum, highlighted by its rising volumes, growing ecosystem, and even a fierce bidding war for its stablecoin USDH.

However, he also warned that it faces its first serious test, as nearly US$12 billion (AU$18.2 billion) in team unlocks are set to hit the market, far outpacing current buybacks.

After dropping about 10% in the last day, the price of HYPE is now trading at US$49.20 (AU$74.60), which is lower than its peak of US$59.39 (AU$90.05) four days ago.

In addition to HYPE, the broader cryptocurrency market is losing money. While Ethereum, XRP, and Solana are all down roughly 6%, Bitcoin is down 2%.

Up Only for Crypto?

In a different post, Hayes asserted that once the U.S. Treasury completes replenishing its General Account to US$850 billion (AU$1.3 billion), which will release liquidity back into markets, cryptocurrency markets will become bullish, or go into “up only” mode.

Some analysts are still skeptical of Hayes’ prediction, even though the TGA balance has now surpassed US$807 billion (AU$1.2 trillion). In contrast to Hayes, André Dragosch, head of research for Bitwise in Europe, stated that “net liquidity has at best a loose correlation to Bitcoin and crypto.”

So, while Hayes views TGA flows as crucial to crypto’s direction — acting like a liquidity switch for the whole financial system — critics such as Dragosch argue they are mostly noise.

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.