Brazil Implements a Uniform Tax Rate of 17.5% on Cryptocurrency Earnings, Abolishing the Exemption for Minor Investors

Brazil has abolished a longstanding tax exemption on cryptocurrency gains. A new provisional measure (MP 1303) imposes a 17.5% tax on all individual crypto profits.

In the past, individuals who sold cryptocurrency worth up to R$35,000 (approximately $6,300) per month were exempt from taxes. Before the adjustment, profits exceeding that threshold were subject to progressive taxation, culminating in a rate of 22.5% for amounts greater than $5.4 million.

According to the local news outlet Portal do Bitcoin, this system is being replaced by a flat tax under the new rule, which means that smaller investors will bear a greater tax burden while larger holders may see a reduction in their bills.

The tax will be applicable regardless of the location of the assets, including overseas exchanges or self-custodial wallets. Losses can be balanced out, but only within a rolling five-quarter window, with this rule becoming stricter starting in 2026.

The administration claims the reform is intended to increase tax income after retracting a suggested increase in the IOF financial transaction tax, which had faced backlash from both industry and Congress.

In addition to crypto, the new measure impacts fixed-income investments and online betting. Fixed-income investments will now incur a fixed 5% tax on earnings, while taxes on operator revenues in online betting will increase from 12% to 18%.

SOL Rebounds Towards $145 as 7 ETFs Progress and DeFi Dev Corp Plans More SOL Acquisitions

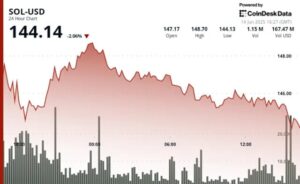

On June 14, Solana (SOL) was priced at $144.14, reflecting a 2.06% decline in the last 24 hours. However, it demonstrated resilience due to long-term institutional activity counteracting retail-driven weakness. In the wake of a broader multi-day correction across crypto markets linked to rising geopolitical tension, price action remains anchored near the lower end of its recent $145–$149 consolidation zone.

James Seyffart from Bloomberg confirmed on Friday that all seven spot Solana ETF issuers, including Fidelity, Grayscale, VanEck, 21Shares, Franklin, Bitwise, and Canary Marinade, submitted updated S-1 filings with the SEC this week. Every filing now incorporates staking provisions, aligning them structurally with Solana’s on-chain economics.

Secondly, on Thursday, DeFi Development Corp, a Solana treasury firm listed on Nasdaq, declared that it had established a $5 billion equity line of credit (ELOC) agreement with RK Capital. With this facility, DeFi Dev Corp can issue shares incrementally to fund further SOL accumulation instead of depending on a single offering with a fixed price.

This comes after a minor regulatory setback: the company applied to the SEC on Wednesday to withdraw its registration statement on Form S-3. It stated that it wished to retract a previous S-3 filing because of technical eligibility problems identified by the SEC. The company stated that it would submit a resale registration statement in the future to generate the necessary capital.

The firm underscored its ongoing dedication to expanding its SOL treasury, which currently contains more than 609,190 tokens worth upwards of $97 million, despite the filing setback. In a press release on Thursday, CEO Joseph Onorati stated that the new capital structure provides a “clean, strategic path” for scaling exposure and compounding validator yield.

As these institutional tailwinds strengthen, SOL’s price seems to be stabilizing, despite a lack of retail activity.

Technical Analysis Highlights

-

SOL traded in a 24-hour range of $4.57 (3.08%), from $144.13 to $148.70.

-

Initial strength faded, with price drifting toward the $144 support level.

-

Resistance remains firm near $149, while short-term rejection hit $145.78.

-

High-volume selling occurred between 13:41–13:47 UTC, with a sharp drop from $145.95.

-

A volume spike at 13:23 UTC aligned with the failed breakout.

-

Whale accumulation continues below $146, though follow-through remains limited.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.