Ethereum price surged 12% in four days, overtaking Solana and XRP

Ethereum price surged 12% in four days, overtaking Solana and XRP as Trump’s policy shift boosted risk appetite across global markets. Ethereum’s Late Rally Over SOL and XRP Is Driven by Its Undervalued Status On April 25, the price of Ethereum surpassed $1,825 to reach its highest level in 50 days. Even though the week got out to a slow start, ETH now records a 12% weekly increase, surpassing leading Layer-1 competitors Solana (SOL) and XRP.

Ethereum’s discounted status was a key factor in its late rise.

ETH had trouble gaining traction in the beginning of the week, consolidating below $1,600 for 14 days from April 9 to April 23.

Earlier in the week, Bitcoin (BTC), XRP, and Solana had already breached significant psychological barriers—$90,000, $2.20, and $150, respectively—while ETH was still trapped below the $1,620 obstacle.

Global market sentiment, however, turned around once former US President Donald Trump loosened his position on tariffs and pushed the Fed to lower interest rates.

Investors who had money sitting on the sidelines thought ETH was cheap in comparison to the market as a whole.The price of Ethereum increased by 12% in just four days, from $1,600 on April 22 to $1,825 on Saturday, April 26 due to rapid inflows.

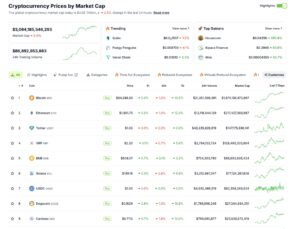

Ethereum’s late rally now places it ahead of Solana and XRP in weekly performance, with the latter two posting 5.3% and 6.9% gains, respectively, according to CoinGecko data as of April 26.

Amid rumors of institutional migration from Ethereum to Solana, bullish investors stake 91,000 ETH.

Trends on the Ethereum 2.0 staking network support the theory that investors flooded into ETH after Trump hinted at a tariff rollback earlier this week.

Since April 22, Ethereum has seen a steady stream of new deposits, per official Beacon Chain data.

On April 22, the total amount of Ethereum staked was 34,055,790, according to Beaconcha in.

Deposits increased steadily after Trump announced he would be calling Chinese President Xi Jinping, and as of April 26, they stood at 34,146,222 ETH.

At current market values, this is a 90,432 ETH increase, or around $164 million.

There are two main reasons why increased staking usually has a beneficial effect on asset prices: First, it tightens liquidity during times of high demand by lowering the amount of marketable ETH that is available on exchanges.

Despite its sluggish start, this supply shock enabled ETH to surpass competitors SOL and XRP on the weekly timeframe.

Second, increasing staking participation indicates that major investors and Ethereum’s core developers remain confident in the network’s long-term sustainability.

Neutral traders and newcomers are frequently encouraged to hold long positions by such actions.

Furthermore, Ethereum staking limits liquidity in terms of time.

It can take up to nine days to withdraw money from the Beacon Chain, according to validator platform Figment.io.

Strong short-term support for ETH will be established even if general market sentiment falls next week because of this lock-up period, which prevents the $164 million in fresh staking deposits from being immediately available for sell-offs.

Ethereum Price Forecast Today: ETH Eyes $1,950 if Momentum Holds Above $1,800

At the time of writing on April 26, the price of Ethereum is hanging over $1,802, as bulls attempt to form a solid bullish cluster above the crucial psychological $1,800 level.

ETH is currently aiming for the midline resistance at $1,928 after rising from the vicinity of the lower band at $1,511, according to the Keltner Channel indicator.

Volume Delta, which printed a positive 47,260 ETH in the most recent session—the highest in two weeks—confirms bullish momentum.

From oversold territory at 31.74 to 39.58, the Relative Strength Index (RSI) has recovered significantly, indicating growing bullish divergence.

Ethereum price forecast today suggests a continuation toward $1,928 if buyers maintain dominance.

With $1,950 appearing as the next significant resistance, a trend move into the Keltner Channel midline would be confirmed by a daily closing over $1,850.

On the other hand, if $1,800 is not held, ETH may be subject to fresh selling pressure, with an immediate risk of a decline to $1,700, the price at which the previous consolidation took place.

But given the RSI recovery and strengthening Etheruem market volume dynamics, the probabilities now marginally support a bullish continuation into early May.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.