Is Ethereum’s Capitulation Coming to an End? Important On-Chain Data Provides New Information

Ethereum (ETH) may have already entered its capitulation phase for this market cycle, according to a recent X post by seasoned cryptocurrency analyst Ali Martinez. Notably, during the past year, the second-largest cryptocurrency by market capitalization has dropped by more than 55%.

Is Ethereum Capitulation Over?

In contrast to Bitcoin (BTC) and other cryptocurrencies like XRP, Solana (SOL), and SUI, Ethereum has had a difficult two-year run. On April 11, 2023, precisely two years ago, the price of the cryptocurrency was $1,892. Today, it is trading at about $1,560, which is more than 17% less.

On the other hand, Bitcoin has increased by about 100%, from about $41,000 two years ago to $82,127 at the time of writing. Unlike ETH, SOL is now trading below its April 2023 price, but it did hit a new all-time high (ATH) of $293 in January of this year.

It makes sense that investor sentiment for ETH is at or close to all-time lows, among both institutional and retail investors. Martinez thinks that “smart money,” on the other hand, might be building up at the present levels in anticipation of a short-term collapse.

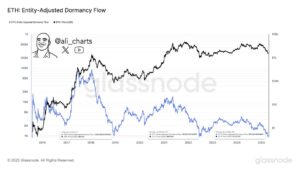

The Entity-Adjusted Dormancy Flow of Ethereum has lately fallen below one million, the expert noted. Martinez also said:

This usually signals a macro bottom zone, which suggests that $ETH may be cheap and that long-term investors are less likely to sell. Additionally, it implies that emotion is low, that there may have been a capitulation, and that smart money may be amassing.

The market cap and the dormancy, or average age of ETH being transferred, are compared using Ethereum’s Entity-Adjusted Dormancy Flow, an on-chain indicator that accounts for unique entities rather than raw addresses. By monitoring the actions of long-term holders, the indicator assists in determining whether the market is overheated or undervalued.

ETH might be on the verge of a momentum reversal if past patterns are any indication. Crypto trader Merlijn The Trader implied in a different X post that Bitcoin Dominance (BTC.D) is approaching a peak, which may cause investors to move money into altcoins and start a brief rally.

At the time of writing, BTC.D stands around 63.5%. A potential pivot by the US Federal Reserve toward quantitative easing (QE) could inject fresh liquidity into the market, possibly sparking a mini altcoin rally.

ETH Demands Cautious Optimism

Although there are several indications that Ethereum might be on the verge of bottoming out, other indicators imply that the digital currency may continue to decline before any significant momentum shift occurs.

Martinez said in a recent report that if the current sell-off continues, ETH may drop as low as $1,200. Furthermore, the short-term prognosis of the asset is still threatened by continuous capital withdrawals from US-based spot Ethereum exchange-traded funds (ETF).

Nevertheless, cryptocurrency an investigator NotWojak recently pointed out that ETH might be about to break out, with a possible upward objective of $1,835. ETH is currently trading at $1,557, down 2.3% over the last day.

Disclaimer and Risk Warning

coinweck does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. coinweck should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.